Who Receives A 1099

The 1099 form is a series of documents used by the Internal Revenue Service (IRS) to report various types of income that are not subject to withholding, such as freelance work, self-employment, and other non-employee compensation. The most common types of 1099 forms include the 1099-MISC, 1099-INT, 1099-DIV, and 1099-K. In this article, we will explore who receives a 1099 form and the different types of income that are reported on these forms.

Who Receives a 1099 Form?

Generally, anyone who receives income that is not subject to withholding is eligible to receive a 1099 form. This includes freelancers, independent contractors, self-employed individuals, and businesses that receive certain types of income. Some common examples of individuals who may receive a 1099 form include:

- Freelance writers, designers, and consultants

- Independent contractors, such as electricians, plumbers, and carpenters

- Self-employed individuals, such as small business owners and entrepreneurs

- Rental property owners who receive rental income

- Investors who receive interest, dividends, or capital gains

Types of 1099 Forms

There are several types of 1099 forms, each used to report different types of income. Some of the most common types of 1099 forms include:

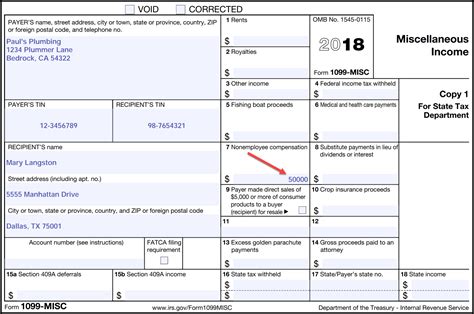

1099-MISC: This form is used to report miscellaneous income, such as freelance work, independent contracting, and self-employment income. It is also used to report other types of income, such as prizes, awards, and royalties.

1099-INT: This form is used to report interest income, such as interest earned on bank accounts, bonds, and other investments.

1099-DIV: This form is used to report dividend income, such as dividends earned on stock investments.

1099-K: This form is used to report payment card and third-party network transactions, such as credit card payments and online transactions.

| Type of 1099 Form | Description |

|---|---|

| 1099-MISC | Miscellaneous income, such as freelance work and self-employment income |

| 1099-INT | Interest income, such as interest earned on bank accounts and investments |

| 1099-DIV | Dividend income, such as dividends earned on stock investments |

| 1099-K | Payment card and third-party network transactions, such as credit card payments and online transactions |

Thresholds for Receiving a 1099 Form

The IRS has established thresholds for receiving a 1099 form, which vary depending on the type of income and the type of payer. For example:

De minimis rule: The IRS has a de minimis rule that requires businesses to issue 1099 forms only for payments that exceed $600 in a calendar year. However, this rule does not apply to all types of income, and some payers may be required to issue 1099 forms for smaller amounts.

1099-MISC: Businesses must issue a 1099-MISC form to recipients who receive $600 or more in miscellaneous income in a calendar year.

1099-INT: Banks and other financial institutions must issue a 1099-INT form to recipients who earn $10 or more in interest income in a calendar year.

1099-DIV: Businesses must issue a 1099-DIV form to recipients who earn $10 or more in dividend income in a calendar year.

1099-K: Payment card processors and third-party networks must issue a 1099-K form to recipients who receive $20,000 or more in gross payments and have 200 or more transactions in a calendar year.

Penalties for Not Receiving a 1099 Form

Businesses that fail to issue 1099 forms to recipients or file the forms with the IRS may be subject to penalties. The penalties can range from 30 to 100 per form, depending on the circumstances, and can be as high as $250,000 or more for intentional disregard of the requirements.

Who is required to receive a 1099 form?

+Anyone who receives income that is not subject to withholding, such as freelancers, independent contractors, self-employed individuals, and businesses that receive certain types of income.

What types of income are reported on a 1099 form?

+Miscellaneous income, interest income, dividend income, and payment card and third-party network transactions, among others.

What are the thresholds for receiving a 1099 form?

+The thresholds vary depending on the type of income and the type of payer, but generally range from 10 to 600 or more in a calendar year.