Whers My Refund

Receiving a refund can be a frustrating and time-consuming process, especially when it seems like it's taking forever to arrive. If you're wondering where your refund is, there are several steps you can take to track it down and get your money back. In this article, we'll explore the common reasons for delayed refunds, how to check the status of your refund, and what to do if your refund is missing.

Understanding the Refund Process

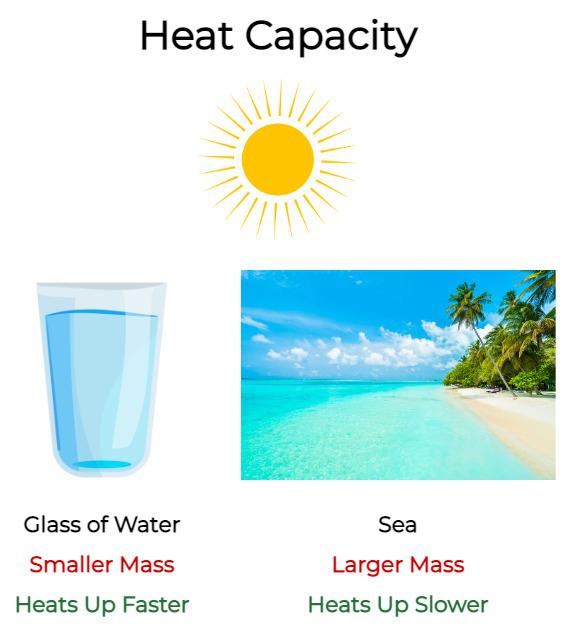

When you return an item or cancel a service, the company typically initiates a refund process. This process can take several days to several weeks, depending on the company’s policies and the method of refund. Refunds can be issued via credit card, bank transfer, or check, and each method has its own processing time. It’s essential to understand the refund process and the estimated timeframe for receiving your refund.

Common Reasons for Delayed Refunds

There are several reasons why your refund might be delayed. Some common causes include:

- Insufficient information: If the company doesn’t have the correct information, such as your address or bank account details, it can delay the refund process.

- Processing time: Refunds can take time to process, especially if the company has a high volume of returns or cancellations.

- Technical issues: Technical problems, such as system glitches or maintenance, can cause delays in the refund process.

To avoid delays, it's crucial to provide accurate information and follow up with the company if you haven't received your refund within the estimated timeframe.

| Refund Method | Processing Time |

|---|---|

| Credit Card | 3-5 business days |

| Bank Transfer | 5-7 business days |

| Check | 7-10 business days |

Tracking Your Refund

To track your refund, you can follow these steps:

- Check your email: Look for an email from the company with updates on your refund status.

- Log in to your account: If you have an account with the company, log in to check the status of your refund.

- Contact customer service: Reach out to the company’s customer service department to inquire about the status of your refund.

By following these steps, you can stay informed about the status of your refund and take action if there are any issues.

What to Do If Your Refund Is Missing

If you haven’t received your refund after the estimated timeframe, there are several steps you can take:

- Contact the company: Reach out to the company’s customer service department to report the missing refund.

- File a complaint: If the company is unresponsive or unwilling to help, you can file a complaint with the relevant consumer protection agency.

- Seek assistance from your bank: If the refund was supposed to be deposited into your bank account, contact your bank to see if they can assist you in recovering the missing funds.

How long does it take to process a refund?

+The processing time for refunds can vary depending on the company and the method of refund. Typically, refunds can take anywhere from 3-10 business days to process.

What should I do if my refund is missing?

+If your refund is missing, contact the company’s customer service department to report the issue. They may be able to provide you with an update or offer alternative solutions. If the company is unresponsive, you can file a complaint with the relevant consumer protection agency.

Can I track my refund online?

+Yes, many companies offer online tracking for refunds. You can log in to your account or check your email for updates on the status of your refund.