What Is Sales Tax Georgia? Easy Calculation Guide

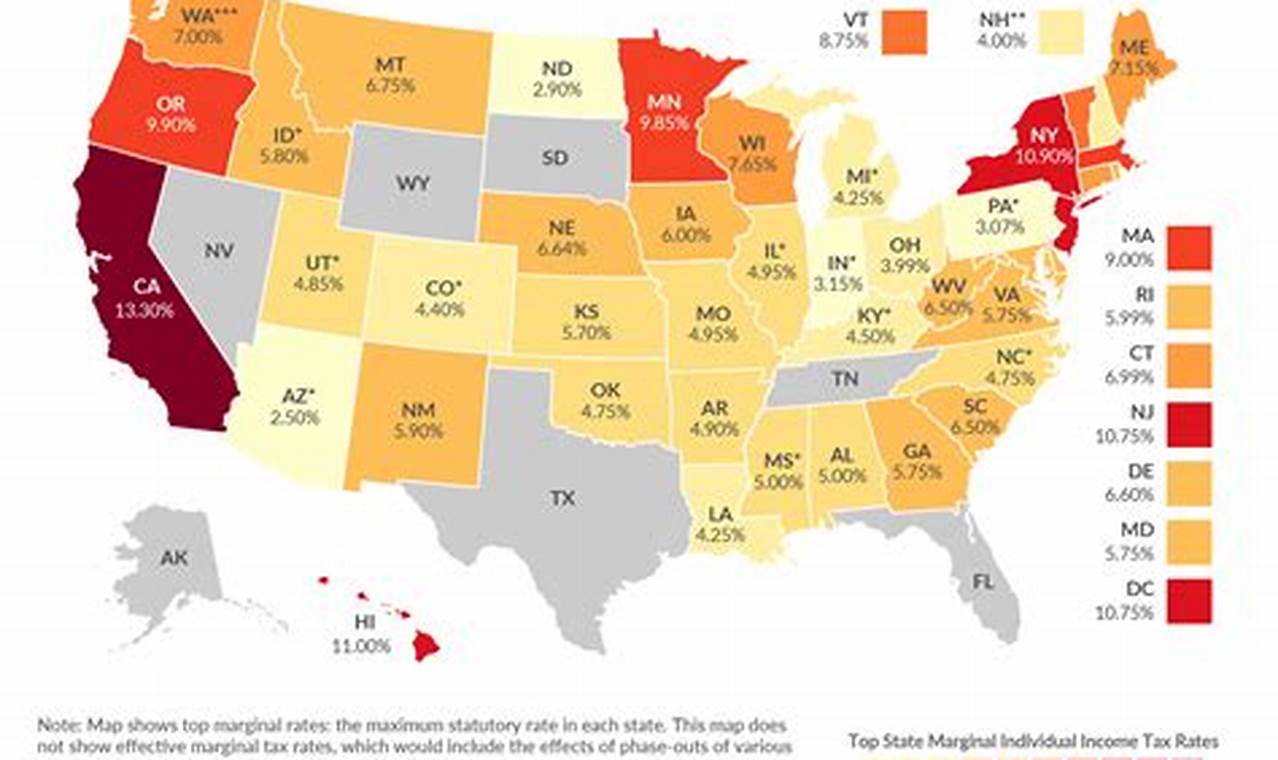

Sales tax in Georgia is a type of consumption tax that is levied on the sale of tangible personal property and certain services. The state of Georgia imposes a sales tax rate of 4% on most purchases, but local governments can also impose their own sales tax rates, which can range from 1% to 4%. This means that the total sales tax rate in Georgia can vary depending on the location of the purchase. In this article, we will provide an easy calculation guide for sales tax in Georgia, including the different rates that apply to various types of purchases.

Understanding Sales Tax Rates in Georgia

In Georgia, the state sales tax rate is 4%. However, local governments can also impose their own sales tax rates, which are often referred to as local option sales taxes (LOST). These rates can vary depending on the county or city where the purchase is made. For example, the city of Atlanta has a total sales tax rate of 8.9%, which includes the 4% state sales tax rate and a 4.9% local sales tax rate. To calculate the total sales tax rate, you need to add the state sales tax rate to the local sales tax rate.

Calculating Sales Tax in Georgia

Calculating sales tax in Georgia is relatively straightforward. To calculate the sales tax, you need to multiply the purchase price of the item by the total sales tax rate. For example, if you purchase an item for 100 and the total sales tax rate is 8.9%, the sales tax would be 8.90. You can calculate the sales tax using the following formula: Sales Tax = Purchase Price x Total Sales Tax Rate.

| Location | State Sales Tax Rate | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| Atlanta | 4% | 4.9% | 8.9% |

| Savannah | 4% | 3.5% | 7.5% |

| Augusta | 4% | 3.0% | 7.0% |

Types of Sales Tax in Georgia

There are several types of sales tax in Georgia, including state sales tax, local sales tax, and special district sales tax. The state sales tax rate is 4%, while local sales tax rates can vary depending on the location. Special district sales tax rates are imposed by special districts, such as transportation districts or development authorities. These rates can also vary depending on the location and type of special district.

Exemptions and Discounts

Certain items and businesses are exempt from sales tax in Georgia. For example, food and prescription medications are exempt from sales tax, as are sales of tangible personal property to non-profit organizations or government agencies. Additionally, some businesses may be eligible for sales tax discounts or exemptions, such as manufacturers or distributors of tangible personal property.

In addition to exemptions and discounts, there are also some special rules and regulations that apply to sales tax in Georgia. For example, the state of Georgia has a use tax that applies to purchases made outside of the state, but used or consumed within the state. This tax is designed to ensure that businesses and individuals are not avoiding sales tax by making purchases outside of the state.

Calculating Sales Tax for Businesses

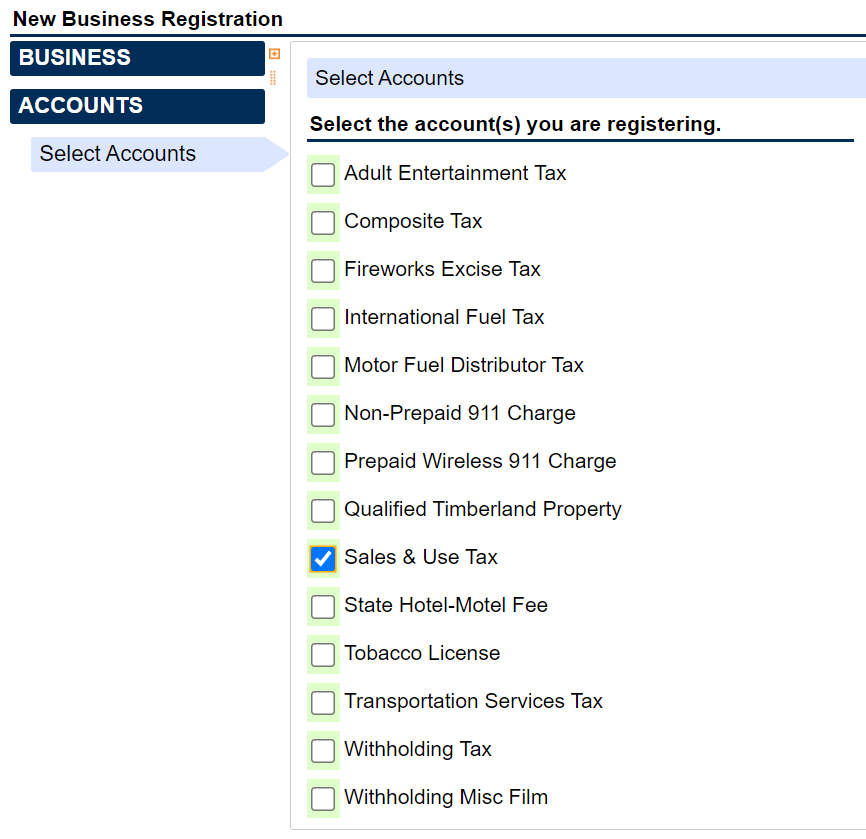

For businesses, calculating sales tax can be more complex than for individuals. This is because businesses may need to calculate sales tax on a variety of different items, including inventory, equipment, and services. Additionally, businesses may need to file sales tax returns and remit sales tax payments to the state of Georgia on a regular basis.

Sales Tax Returns and Payments

In Georgia, businesses are required to file sales tax returns and remit sales tax payments on a monthly or quarterly basis, depending on the amount of sales tax they collect. The state of Georgia provides a variety of resources and tools to help businesses calculate and file sales tax returns, including online filing systems and tax calculators.

To calculate sales tax for businesses, you will need to determine the total sales tax rate that applies to your business, as well as the amount of sales tax you collect on a monthly or quarterly basis. You can use the following formula to calculate sales tax: Sales Tax = Total Sales x Total Sales Tax Rate. You will also need to keep accurate records of your sales and sales tax collections, as well as file sales tax returns and remit sales tax payments to the state of Georgia on a regular basis.

| Business Type | Total Sales Tax Rate | Sales Tax Filing Frequency |

|---|---|---|

| Retail | 8.9% | Monthly |

| Wholesale | 4% | Quarterly |

| Service | 7.5% | Monthly |

What is the sales tax rate in Georgia?

+

The sales tax rate in Georgia is 4% at the state level, but local governments can also impose their own sales tax rates, which can range from 1% to 4%.

How do I calculate sales tax in Georgia?

+

To calculate sales tax in Georgia, you need to multiply the purchase price of the item by the total sales tax rate. The total sales tax rate is the sum of the state sales tax rate and the local sales tax rate.

What items are exempt from sales tax in Georgia?

+

Certain items are exempt from sales tax in Georgia, including food and prescription medications. Additionally, some businesses may be eligible for sales tax exemptions or discounts, such as non-profit organizations or government agencies.