What Is Navient Settlement? Your Repayment Guide

Navient, one of the largest student loan servicers in the United States, has been at the center of controversy and legal battles over its handling of student loans. In recent years, the company has faced numerous lawsuits and investigations, including a multistate lawsuit alleging that it had engaged in unfair and deceptive practices in its servicing of student loans. As a result of these legal actions, Navient has agreed to a settlement that could impact millions of student loan borrowers. In this article, we will delve into the details of the Navient settlement and provide a comprehensive guide on how it may affect your repayment.

Understanding the Navient Settlement

The Navient settlement is a result of a multistate investigation led by several state attorneys general, which found that Navient had engaged in practices that harmed student loan borrowers. The settlement requires Navient to cancel millions of dollars in private student loans and provide restitution to affected borrowers. The settlement also mandates that Navient reform its practices to ensure that it is providing accurate and transparent information to borrowers about their repayment options.

Key Provisions of the Settlement

The Navient settlement includes several key provisions that are designed to provide relief to affected borrowers. These provisions include:

- Cancellation of private student loans: Navient will cancel millions of dollars in private student loans that were made to borrowers who attended certain for-profit schools.

- Restitution to borrowers: Navient will provide restitution to borrowers who were harmed by its practices, including those who were subjected to aggressive collection tactics.

- Reforms to servicing practices: Navient will be required to reform its servicing practices to ensure that it is providing accurate and transparent information to borrowers about their repayment options.

These provisions are designed to provide relief to borrowers who were harmed by Navient's practices and to ensure that the company is held accountable for its actions.

How the Settlement Affects Borrowers

The Navient settlement could have a significant impact on borrowers who have private student loans serviced by the company. Borrowers who are eligible for cancellation of their private student loans will receive notice from Navient and will not be required to take any further action. Borrowers who are eligible for restitution will also receive notice from Navient and will be required to submit a claim to receive their restitution payment.

| Loan Type | Eligibility Criteria |

|---|---|

| Private Student Loans | Borrowers who attended certain for-profit schools |

| Federal Student Loans | Borrowers who were subjected to aggressive collection tactics |

It's essential for borrowers to review their loan documents and to contact Navient if they have any questions about their eligibility for cancellation or restitution.

Repayment Guide for Borrowers

For borrowers who are affected by the Navient settlement, it’s essential to understand their repayment options and to take steps to ensure that they are taking advantage of the relief that is available to them. Here are some steps that borrowers can take:

- Review loan documents: Borrowers should review their loan documents to determine if they are eligible for cancellation or restitution.

- Contact Navient: Borrowers who have questions about their eligibility or who need to submit a claim for restitution should contact Navient directly.

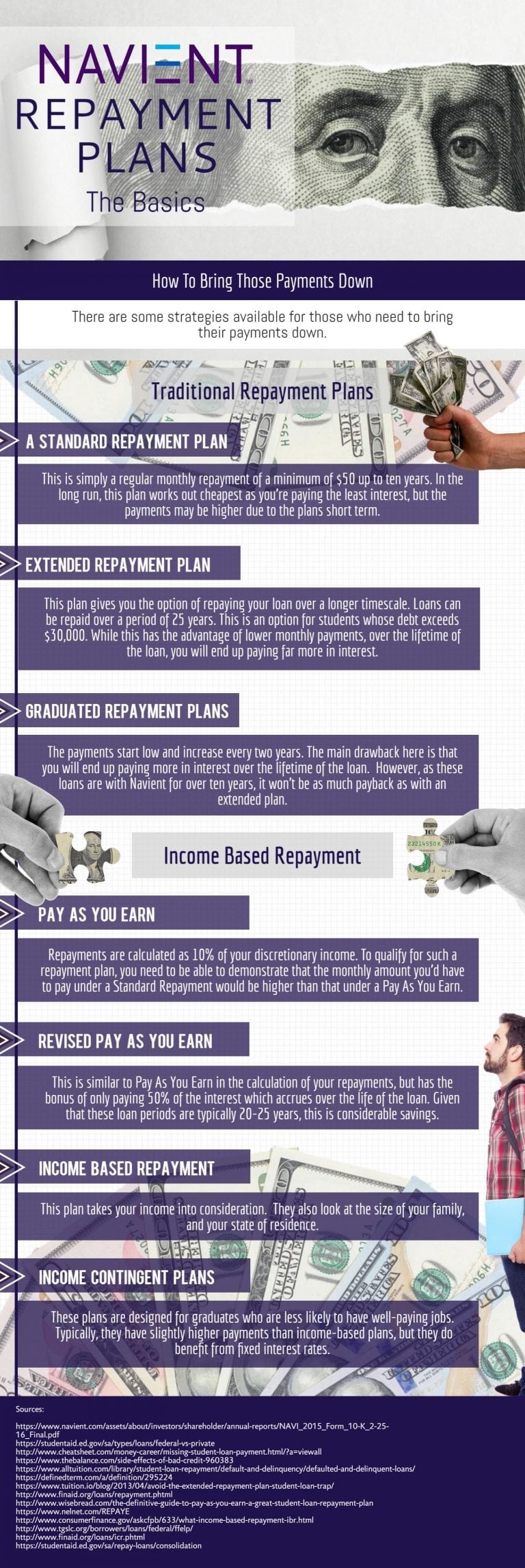

- Explore other repayment options: Borrowers who are not eligible for cancellation or restitution may still be eligible for other forms of relief, such as income-driven repayment plans or Public Service Loan Forgiveness.

By taking these steps, borrowers can ensure that they are taking advantage of the relief that is available to them and that they are making informed decisions about their repayment options.

What is the Navient settlement and how does it affect borrowers?

+The Navient settlement is a result of a multistate investigation that found that Navient had engaged in unfair and deceptive practices in its servicing of student loans. The settlement requires Navient to cancel millions of dollars in private student loans and provide restitution to affected borrowers.

How do I know if I am eligible for cancellation or restitution under the Navient settlement?

+Borrowers who are eligible for cancellation or restitution will receive notice from Navient. Borrowers can also contact Navient directly to determine their eligibility.

What are my repayment options if I am not eligible for cancellation or restitution under the Navient settlement?

+Borrowers who are not eligible for cancellation or restitution may still be eligible for other forms of relief, such as income-driven repayment plans or Public Service Loan Forgiveness. Borrowers should contact their loan servicer to explore their options.