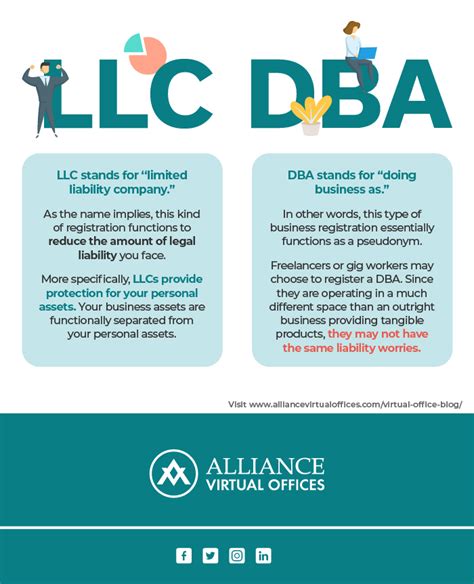

What Is An Llc

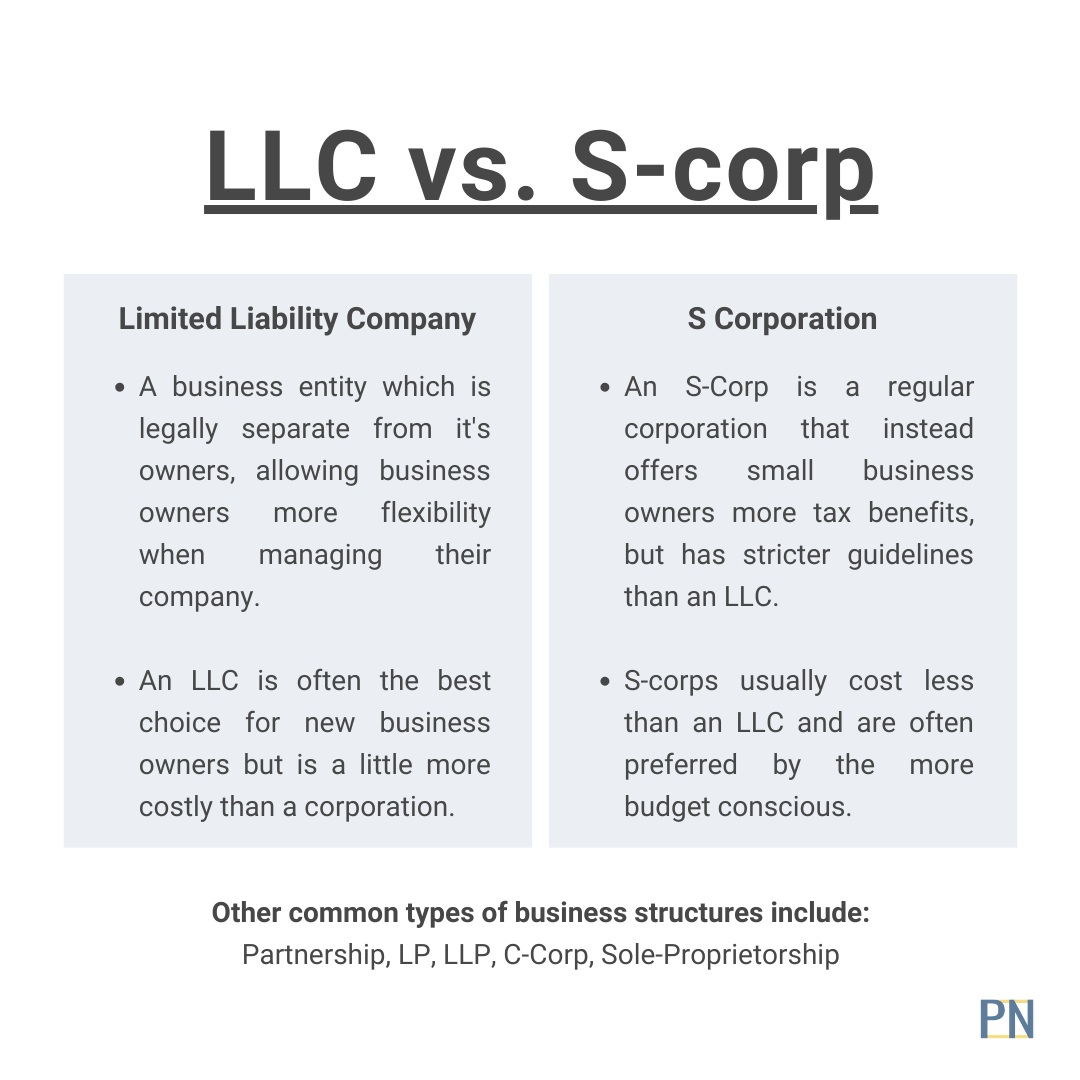

A Limited Liability Company, commonly referred to as an LLC, is a type of business structure that offers personal liability protection for its owners, known as members. This hybrid entity combines the benefits of a corporation's liability protection with the tax advantages and flexibility of a partnership. In this article, we will delve into the details of what an LLC is, its advantages, and how it operates.

Definition and Characteristics

An LLC is a legal entity that is separate from its owners, providing a level of protection for their personal assets in case the business is sued or incurs debt. The key characteristics of an LLC include:

- Personal Liability Protection: Members are not personally responsible for the company's debts or liabilities, protecting their personal assets such as homes, cars, and bank accounts.

- Tax Flexibility: LLCs can choose to be taxed as a pass-through entity, where the business income is only taxed at the individual level, or as a corporation, where the business is taxed separately.

- Flexible Ownership Structure: LLCs can have any number of members, and ownership can be divided into different percentages or classes.

- Operational Flexibility: LLCs can be managed by their members or by hired managers, allowing for flexibility in decision-making and operations.

Formation and Requirements

Forming an LLC typically involves the following steps:

- Choosing a Business Name: The name must be unique and comply with the state's naming requirements.

- Filing Articles of Organization: The LLC's formation documents must be filed with the state, providing basic information about the business.

- Obtaining Licenses and Permits: The LLC may need to obtain licenses and permits to operate, depending on the industry and location.

- Creating an Operating Agreement: An internal document that outlines the company's management structure, ownership, and operating procedures.

| State | Filing Fee |

|---|---|

| California | $70 |

| New York | $200 |

| Florida | $125 |

Advantages of an LLC

The benefits of forming an LLC include:

- Liability Protection: Protects personal assets from business-related risks.

- Tax Benefits: Can choose pass-through taxation, avoiding double taxation.

- Credibility and Legitimacy: Establishes a formal business structure, enhancing credibility with customers and partners.

- Flexibility in Ownership and Management: Allows for flexible ownership structures and management arrangements.

Disadvantages of an LLC

While LLCs offer many benefits, there are some potential drawbacks to consider:

- Complexity in Formation and Maintenance: Requires more formalities than sole proprietorships or partnerships.

- Costs and Fees: Involves filing fees, annual report fees, and potential costs for legal and accounting services.

- Self-Employment Taxes: Members may be subject to self-employment taxes on their share of the business income.

What is the main advantage of forming an LLC?

+The main advantage of forming an LLC is personal liability protection, which safeguards the owners’ personal assets from business-related risks.

How do I choose the right business structure for my company?

+Consider factors such as the number of owners, tax implications, and liability protection when deciding between an LLC, sole proprietorship, partnership, or corporation. Consult with an attorney or accountant to determine the best structure for your business.

Can an LLC have only one owner?

+Yes, an LLC can have only one owner, known as a single-member LLC. This structure still provides personal liability protection and tax benefits, but may have different tax implications and requirements than a multi-member LLC.