Washington Tax Overview: Your Complete Handbook

Located in the Pacific Northwest, Washington is a state known for its stunning natural beauty, vibrant cities, and thriving economy. As a resident or business owner in Washington, it's essential to understand the state's tax landscape to ensure compliance and maximize your financial situation. In this comprehensive handbook, we'll delve into the Washington tax overview, covering key aspects such as income tax, sales tax, property tax, and more.

Income Tax in Washington

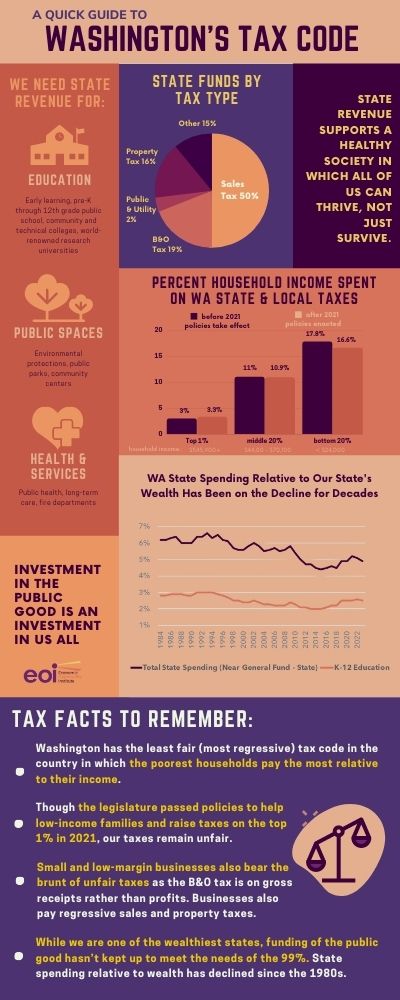

Washington is one of the few states in the US with no state income tax. This means that residents of Washington do not have to pay state income tax on their earnings. However, it’s crucial to note that the federal government still imposes income tax on all US citizens, including those residing in Washington. The state’s lack of income tax is a significant advantage for individuals and businesses, making it an attractive location for those looking to minimize their tax burden.

Types of Income Taxable by the Federal Government

Although Washington state does not impose income tax, the federal government taxes various types of income, including:

- Wages and salaries

- Interest and dividends

- Capital gains

- Rental income

- Self-employment income

It’s essential to understand which types of income are subject to federal taxation to ensure accurate reporting and compliance.

Sales Tax in Washington

Washington state imposes a sales tax on the sale of most tangible personal property and certain services. The state sales tax rate is 6.5%, but local jurisdictions may impose additional sales taxes, resulting in a combined rate ranging from 7% to 10.4% depending on the location. Some common items subject to sales tax in Washington include:

- Tangible personal property, such as clothing, furniture, and electronics

- Certain services, like restaurant meals, hotel stays, and amusement park admissions

However, some items are exempt from sales tax, including:

- Food and food ingredients for human consumption

- Prescription medications

- Certain medical equipment and supplies

Sales Tax Rates in Major Washington Cities

The combined sales tax rate varies across different cities in Washington. Here are some examples:

| City | Sales Tax Rate |

|---|---|

| Seattle | 10.4% |

| Spokane | 8.9% |

| Tacoma | 10.4% |

| Vancouver | 8.4% |

It’s essential to understand the sales tax rate in your specific location to ensure accurate calculation and payment of sales tax.

Property Tax in Washington

Property tax is a significant source of revenue for local governments in Washington. The state imposes a property tax on real and personal property, including:

- Residential and commercial real estate

- Farm and agricultural land

- Personal property, such as vehicles and equipment

The property tax rate in Washington varies depending on the location and type of property. The average effective property tax rate in Washington is around 0.93%, which is slightly lower than the national average.

Property Tax Exemptions and Deferrals

Washington state offers several property tax exemptions and deferrals to help reduce the tax burden on certain individuals and organizations. These include:

- Senior citizen and disabled person exemptions

- Veteran exemptions

- Non-profit organization exemptions

- Property tax deferrals for low-income individuals

It’s crucial to understand the eligibility criteria and application process for these exemptions and deferrals to ensure you’re taking advantage of the available tax savings.

Other Taxes in Washington

Washington state imposes several other taxes, including:

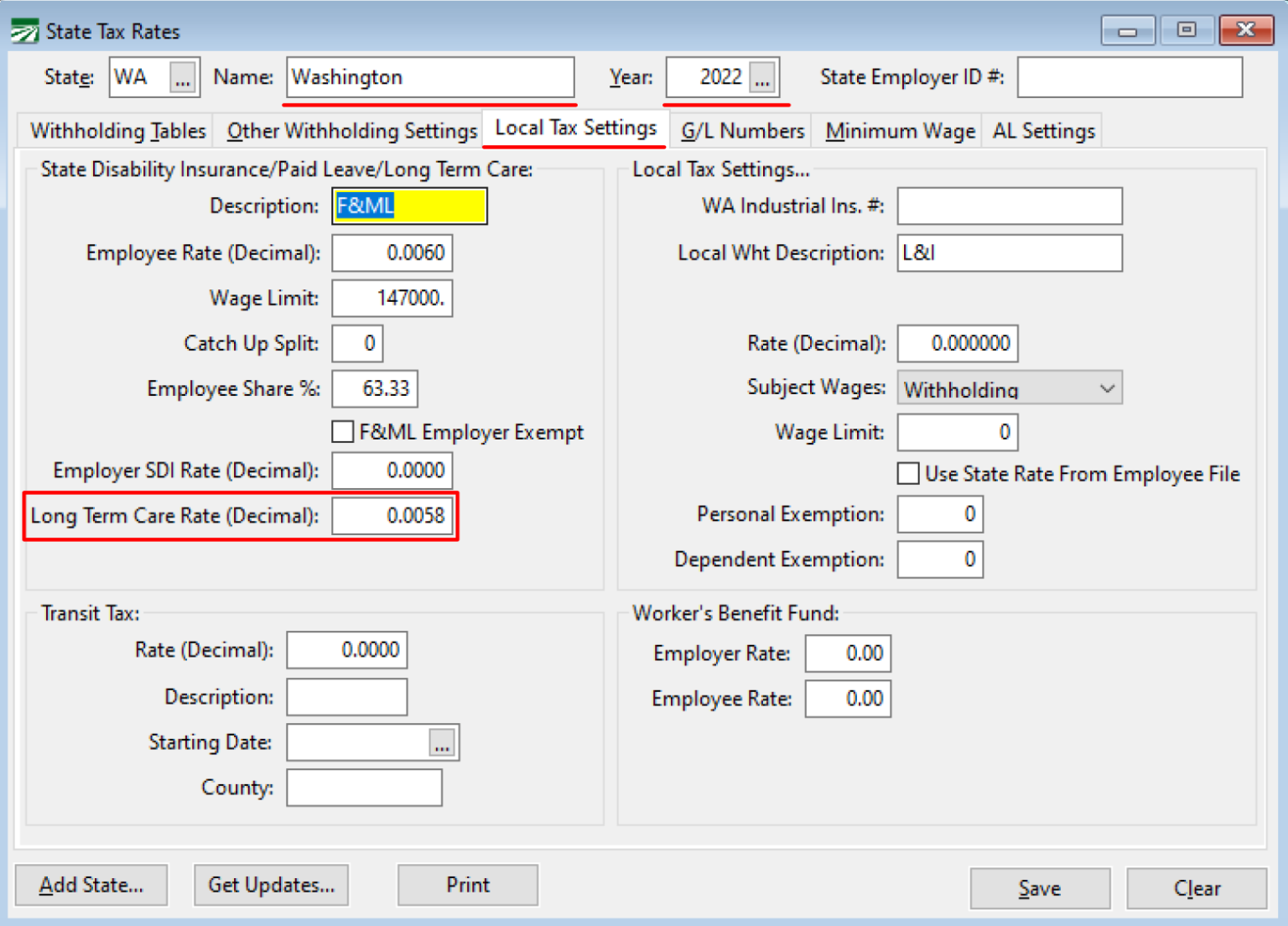

- Business and occupation (B&O) tax: a tax on the gross income of businesses operating in the state

- Use tax: a tax on the use of tangible personal property in the state, applicable to out-of-state purchases

- Estate tax: a tax on the transfer of property upon death, with a top rate of 20%

Understanding these taxes and their implications is crucial for individuals and businesses to ensure compliance and minimize their tax liability.

What is the sales tax rate in Seattle, Washington?

+The combined sales tax rate in Seattle, Washington is 10.4%, which includes the state sales tax rate of 6.5% and the local sales tax rate of 3.9%.

Are there any property tax exemptions available for seniors in Washington state?

+Yes, Washington state offers a property tax exemption for seniors and disabled persons. Eligible individuals may qualify for a reduction in their property tax liability, which can help reduce their overall tax burden.

What is the business and occupation (B&O) tax rate in Washington state?

+The business and occupation (B&O) tax rate in Washington state varies depending on the type of business and the classification of the business activity. The tax rates range from 0.138% to 1.5% of the business’s gross income.