Llc Formation Made Easy: Stepbystep Guide

Forming a Limited Liability Company (LLC) can be a complex and daunting task, especially for those who are new to the world of business. However, with the right guidance, it can be a straightforward and efficient process. In this article, we will provide a step-by-step guide on how to form an LLC, highlighting the key requirements, benefits, and considerations to keep in mind. Whether you're a seasoned entrepreneur or just starting out, this guide will walk you through the LLC formation process, ensuring that you're well-equipped to navigate the process with confidence.

Understanding the Basics of LLC Formation

Before diving into the formation process, it’s essential to understand the basics of an LLC. A Limited Liability Company is a type of business structure that offers personal liability protection for its owners, known as members. LLCs are often preferred over other business structures, such as sole proprietorships or partnerships, due to their flexibility and tax benefits. LLCs can be owned by one or more individuals, and they can be managed by their members or by a separate management team. This flexibility makes LLCs an attractive option for businesses of all sizes and types.

Benefits of Forming an LLC

There are several benefits to forming an LLC, including personal liability protection, which shields members from business-related lawsuits and debts. Additionally, LLCs offer tax flexibility, as they can be taxed as pass-through entities, partnerships, or corporations. This flexibility allows businesses to choose the tax structure that best suits their needs. Furthermore, LLCs are often viewed as more formal and legitimate than sole proprietorships or partnerships, which can enhance credibility and increase business opportunities.

The following table highlights the key benefits of forming an LLC:

| Benefit | Description |

|---|---|

| Personal Liability Protection | Protects members from business-related lawsuits and debts |

| Tax Flexibility | Can be taxed as pass-through entities, partnerships, or corporations |

| Enhanced Credibility | Viewed as more formal and legitimate than sole proprietorships or partnerships |

Step-by-Step Guide to LLC Formation

Now that we've covered the basics and benefits of LLC formation, let's dive into the step-by-step guide. The following sections will walk you through the process of forming an LLC, from choosing a business name to filing for taxes.

Step 1: Choose a Business Name

The first step in forming an LLC is to choose a business name. This name must be unique and comply with the naming requirements of your state. It’s essential to conduct a thorough search to ensure that your desired name is not already in use by another business. You can search your state’s business database or use a name search tool to verify the availability of your desired name.

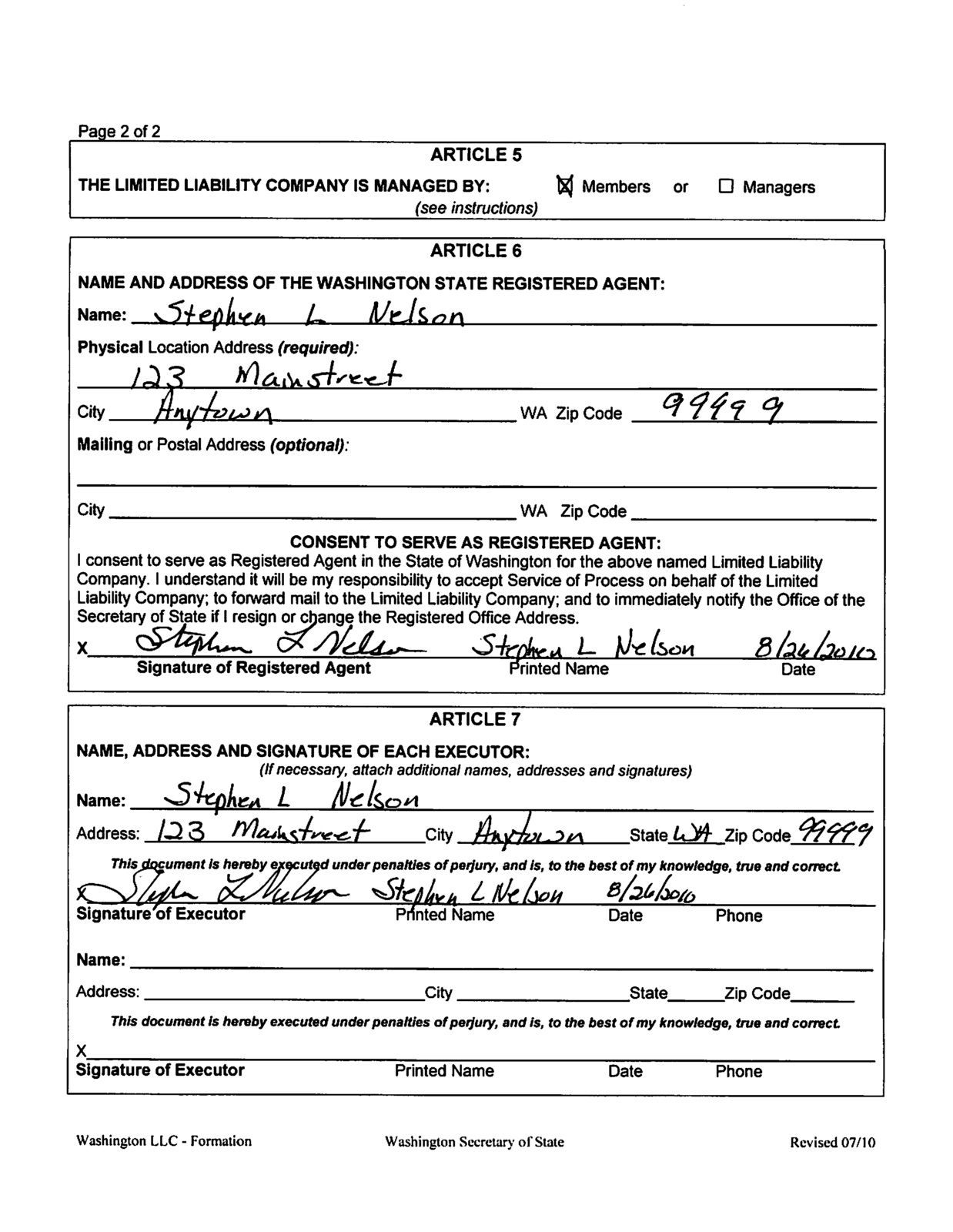

Step 2: File Articles of Organization

Once you’ve chosen a business name, you’ll need to file Articles of Organization with your state’s business registration office. This document provides basic information about your LLC, such as its name, address, and purpose. The filing fee for Articles of Organization varies by state, ranging from 50 to 500.

Step 3: Create an Operating Agreement

An Operating Agreement is a document that outlines the ownership and management structure of your LLC. This agreement should include information on ownership percentages, management roles, and profit distribution. While not always required, an Operating Agreement is highly recommended, as it can help prevent disputes and ensure the smooth operation of your business.

Step 4: Obtain an EIN

An Employer Identification Number (EIN) is a unique identifier assigned to your business by the IRS. You’ll need an EIN to open a business bank account, file for taxes, and hire employees. You can apply for an EIN online through the IRS website or by mail using Form SS-4.

Step 5: File for Taxes

As mentioned earlier, LLCs offer tax flexibility. You’ll need to file for taxes with the IRS and your state’s tax authority. The type of tax return you’ll need to file depends on the tax structure you’ve chosen for your LLC. Consult with a tax professional to ensure you’re meeting all tax requirements and taking advantage of available deductions.

Conclusion and Next Steps

Forming an LLC can be a complex process, but with the right guidance, it can be a straightforward and efficient task. By following the steps outlined in this guide, you’ll be well on your way to establishing a successful and legitimate business. Remember to conduct thorough research, consult with professionals, and keep accurate records to ensure the smooth operation of your LLC.

What is the main benefit of forming an LLC?

+The main benefit of forming an LLC is personal liability protection, which shields members from business-related lawsuits and debts.

How do I choose a business name for my LLC?

+To choose a business name for your LLC, conduct a thorough search to ensure the name is unique and complies with your state’s naming requirements. You can search your state’s business database or use a name search tool to verify the availability of your desired name.

Do I need an Operating Agreement for my LLC?

+While not always required, an Operating Agreement is highly recommended, as it can help prevent disputes and ensure the smooth operation of your business. This document outlines the ownership and management structure of your LLC.