How To Use Free Budget App? Simplify Finances

Managing personal finances can be a daunting task, especially for those who are not familiar with budgeting and financial planning. However, with the advent of technology, there are numerous free budget apps available that can simplify finances and help individuals track their expenses, create a budget, and achieve their financial goals. In this article, we will discuss how to use a free budget app to simplify finances and provide a comprehensive overview of the features and benefits of these apps.

Choosing the Right Free Budget App

With so many free budget apps available, it can be challenging to choose the right one. Some popular options include Mint, Personal Capital, and YNAB (You Need a Budget). When selecting a free budget app, consider the following factors: ease of use, features, security, and customer support. Look for an app that is user-friendly, offers a wide range of features, has robust security measures in place, and provides excellent customer support.

Key Features of Free Budget Apps

Free budget apps typically offer a range of features that can help individuals manage their finances. Some common features include:

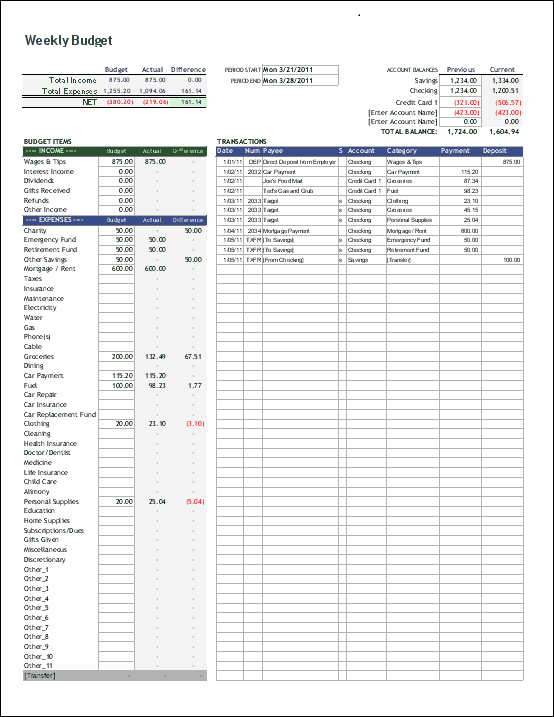

- Expense tracking: The ability to track expenses and categorize them into different categories, such as housing, transportation, and food.

- Budgeting: The ability to create a budget and set financial goals, such as saving for a down payment on a house or paying off debt.

- Investment tracking: The ability to track investments, such as stocks, bonds, and mutual funds.

- Billing reminders: The ability to receive reminders when bills are due, ensuring that payments are made on time.

- Financial alerts: The ability to receive alerts when unusual account activity is detected, helping to prevent fraud and identity theft.

For example, Mint offers a range of features, including expense tracking, budgeting, and investment tracking. It also provides billing reminders and financial alerts, helping users to stay on top of their finances.

| App | Features | Security |

|---|---|---|

| Mint | Expense tracking, budgeting, investment tracking | 256-bit encryption, two-factor authentication |

| Personal Capital | Investment tracking, financial planning, budgeting | 256-bit encryption, two-factor authentication |

| YNAB (You Need a Budget) | Expense tracking, budgeting, financial goals | 256-bit encryption, two-factor authentication |

Using a Free Budget App to Simplify Finances

Once you have chosen a free budget app, it’s time to start using it to simplify your finances. Here are some steps to follow:

- Download and install the app: Go to the app store or website and download the app. Follow the installation instructions to get started.

- Link your accounts: Link your bank accounts, credit cards, and other financial accounts to the app. This will allow you to track your expenses and income.

- Set up your budget: Create a budget that outlines projected income and expenses. You can use the app’s budgeting tools to help you create a budget that works for you.

- Track your expenses: Use the app to track your expenses and categorize them into different categories. This will help you identify areas where you can cut back and make adjustments to your budget.

- Monitor your progress: Use the app to monitor your progress and make adjustments to your budget as needed. You can also use the app to track your investments and receive financial alerts.

For instance, Personal Capital offers a range of tools to help users track their investments and receive financial alerts. It also provides a comprehensive view of your financial situation, making it easier to make informed decisions about your money.

Tips for Getting the Most Out of a Free Budget App

To get the most out of a free budget app, follow these tips:

- Use it regularly: Make it a habit to use the app regularly to track your expenses and income.

- Be honest: Be honest about your spending habits and income. This will help you create a budget that works for you.

- Make adjustments: Make adjustments to your budget as needed. Life is unpredictable, and your budget should be flexible enough to accommodate changes.

- Take advantage of features: Take advantage of the features offered by the app, such as investment tracking and financial alerts.

What is the best free budget app for beginners?

+Mint is a popular and user-friendly option for beginners. It offers a range of features, including expense tracking, budgeting, and investment tracking, and is easy to use.

How do I link my accounts to a free budget app?

+To link your accounts to a free budget app, you will typically need to provide your account login credentials. The app will then use this information to connect to your accounts and track your expenses and income.

Is my financial data secure with a free budget app?

+Yes, most free budget apps use robust security measures to protect your financial data. Look for apps that use 256-bit encryption and offer two-factor authentication to ensure that your data is secure.