Georgia Income Tax: Save Money Now

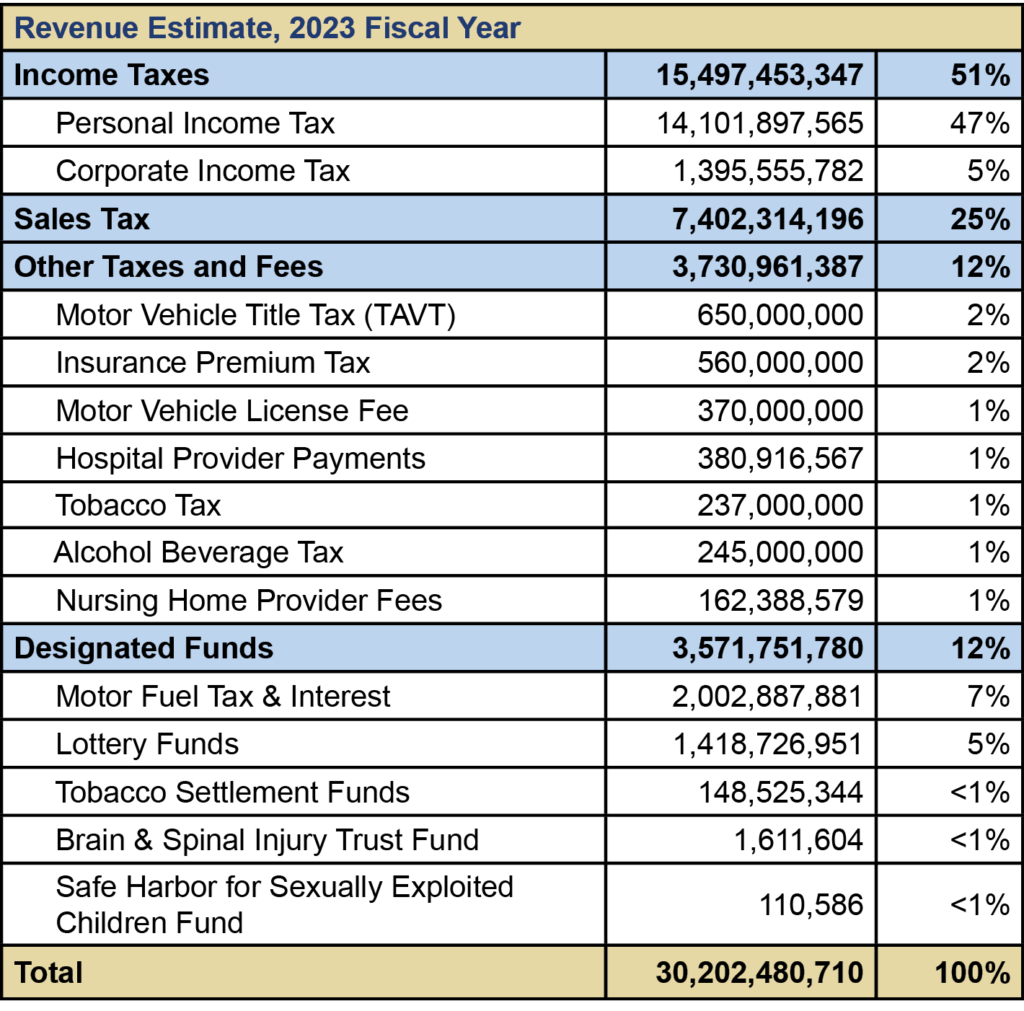

Georgia, known as the Peach State, is a popular destination for individuals and families alike, thanks to its rich history, stunning natural beauty, and thriving economy. However, when it comes to taxes, Georgia residents may face a significant burden. The state income tax rate in Georgia ranges from 1% to 5.75%, with the top rate applying to taxable income exceeding $7,000. To minimize their tax liability and save money, it's essential for Georgians to understand the state's income tax system and explore available tax savings opportunities.

Understanding Georgia Income Tax Rates

Georgia has a progressive income tax system, with six tax brackets and corresponding tax rates. The tax rates are as follows: 1% for taxable income up to 750, 2% for taxable income between 751 and 2,250, 3% for taxable income between 2,251 and 3,750, 4% for taxable income between 3,751 and 5,250, 5% for taxable income between 5,251 and 7,000, and 5.75% for taxable income exceeding 7,000. It’s crucial to note that these tax rates apply to taxable income, which is calculated by subtracting deductions and exemptions from gross income.

Georgia Tax Deductions and Exemptions

Georgia offers various tax deductions and exemptions to help reduce taxable income. For example, the state allows a standard deduction of 4,600 for single filers and 6,000 for joint filers. Additionally, Georgians can claim itemized deductions for mortgage interest, charitable donations, and medical expenses. The state also provides exemptions for certain types of income, such as military pay and Social Security benefits. By taking advantage of these deductions and exemptions, Georgia residents can significantly lower their taxable income and resulting tax liability.

| Tax Bracket | Tax Rate | Taxable Income |

|---|---|---|

| 1 | 1% | Up to $750 |

| 2 | 2% | $751 - $2,250 |

| 3 | 3% | $2,251 - $3,750 |

| 4 | 4% | $3,751 - $5,250 |

| 5 | 5% | $5,251 - $7,000 |

| 6 | 5.75% | Above $7,000 |

Georgia Tax Credits

In addition to deductions and exemptions, Georgia offers various tax credits to help residents save money. For example, the state provides a low-income tax credit for individuals and families with limited income. This credit can be worth up to 50 for single filers and 100 for joint filers. Georgia also offers a child tax credit for families with dependent children, which can be worth up to $100 per child. By claiming these tax credits, Georgians can further reduce their tax liability and keep more of their hard-earned money.

Georgia Tax Savings Strategies

To minimize their tax liability and save money, Georgia residents should consider the following strategies: (1) contribute to a tax-deferred retirement account, (2) itemize deductions for mortgage interest, charitable donations, and medical expenses, (3) claim the standard deduction or itemized deductions, and (4) take advantage of tax credits for low-income individuals and families with dependent children. By implementing these strategies, Georgians can reduce their taxable income, lower their tax liability, and keep more of their money.

- Contribute to a tax-deferred retirement account, such as a 401(k) or IRA

- Itemize deductions for mortgage interest, charitable donations, and medical expenses

- Claim the standard deduction or itemized deductions

- Take advantage of tax credits for low-income individuals and families with dependent children

What is the highest tax rate in Georgia?

+

The highest tax rate in Georgia is 5.75%, which applies to taxable income exceeding $7,000.

Can I claim a deduction for charitable donations in Georgia?

+

Yes, you can claim a deduction for charitable donations in Georgia, as long as you itemize your deductions.

Is Social Security income taxable in Georgia?

+

No, Social Security income is not taxable in Georgia, as the state provides an exemption for this type of income.