Exempt Vs Non Exempt Employee

The distinction between exempt and non-exempt employees is a critical aspect of labor law, significantly impacting how employees are compensated and treated under the Fair Labor Standards Act (FLSA). The FLSA, which is enforced by the U.S. Department of Labor's Wage and Hour Division, sets the minimum wage, overtime pay, and other employment standards. Understanding the differences between exempt and non-exempt employees is essential for both employers and employees to ensure compliance with federal and state laws, avoid potential legal issues, and maintain a fair work environment.

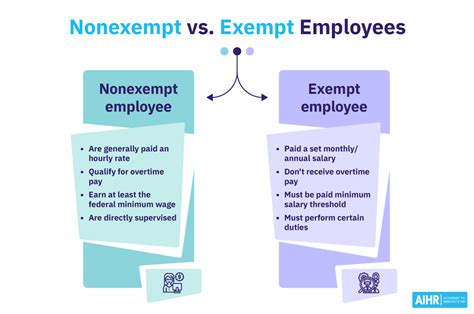

Defining Exempt and Non-Exempt Employees

Exempt employees are those who are exempt from the FLSA’s overtime and minimum wage provisions. Typically, these are high-level employees who are paid on a salary basis and are not entitled to overtime pay, regardless of the number of hours worked. On the other hand, non-exempt employees are covered by the FLSA’s provisions and are entitled to minimum wage and overtime pay for hours worked beyond 40 in a workweek.

Characteristics of Exempt Employees

To qualify as an exempt employee, an individual must meet specific criteria outlined by the FLSA. These criteria often include being paid on a salary basis, earning above a certain threshold, and performing duties that are considered executive, administrative, professional, outside sales, or computer-related. Executive employees, for example, are those who manage the enterprise or a department, customarily and regularly direct the work of at least two or more employees, and have the authority to hire or fire other employees or make suggestions and recommendations as to the change in status of other employees that are given particular weight. Administrative employees, another category, are those whose primary duty is the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers, and whose work includes the exercise of discretion and independent judgment.

Characteristics of Non-Exempt Employees

Non-exempt employees, in contrast, do not meet the exemption criteria and are thus entitled to the protections afforded by the FLSA, including minimum wage and overtime pay. These employees are typically paid on an hourly basis, and their work hours are closely monitored to ensure compliance with labor laws. For non-exempt employees, overtime pay is a critical benefit, as it compensates them for the extra hours worked beyond the standard 40-hour workweek. The FLSA requires that non-exempt employees be paid at least one and one-half times their regular rate of pay for hours worked in excess of 40 in a workweek.

| Employee Type | Key Characteristics | Compensation Requirements |

|---|---|---|

| Exempt | Paid on a salary basis, meets specific duty tests, earns above a certain threshold | No entitlement to overtime pay |

| Non-Exempt | Paid on an hourly basis, does not meet exemption criteria | Entitled to minimum wage and overtime pay |

Implications of Misclassification

Misclassifying employees as exempt when they should be non-exempt can have severe consequences for employers. This includes back pay for overtime not compensated, potential damages, and legal fees. Employers must conduct thorough analyses of job duties and ensure that classifications are accurate to avoid such issues. The U.S. Department of Labor provides guidelines and tools to help employers in this process, but the ultimate responsibility lies with the employer to ensure compliance.

Best Practices for Employers

To avoid misclassification and ensure compliance with labor laws, employers should regularly review job descriptions and classifications. This involves assessing the duties performed by each employee, their compensation, and whether they meet the exemption criteria. Employers should also maintain accurate records of employee work hours, compensation, and job duties. Training for management and HR personnel is crucial to ensure that all employees are correctly classified and that labor laws are adhered to. Furthermore, open communication with employees about their classification and the reasons behind it can help build trust and reduce potential disputes.

What is the difference between exempt and non-exempt employees?

+Exempt employees are not entitled to overtime pay and are typically paid on a salary basis, performing high-level duties that meet specific criteria. Non-exempt employees, on the other hand, are entitled to minimum wage and overtime pay, usually working in roles that do not meet the exemption criteria.

How do employers determine if an employee is exempt or non-exempt?

+Employers determine the exemption status by evaluating the employee’s job duties, compensation, and whether they meet the specific criteria outlined by the FLSA. This includes assessing if the employee is paid on a salary basis, earns above a certain threshold, and performs duties that are considered executive, administrative, professional, outside sales, or computer-related.

What are the consequences of misclassifying an employee as exempt when they should be non-exempt?

+Misclassification can lead to significant legal and financial consequences for employers, including back pay for unpaid overtime, potential damages, and legal fees. It is crucial for employers to accurately classify employees to avoid such issues and ensure compliance with labor laws.