Best Free Budget App

Managing personal finances effectively is crucial for achieving financial stability and security. With the numerous budgeting apps available, selecting the best one can be overwhelming. This article will delve into the world of free budget apps, exploring their features, benefits, and how they can help individuals and households manage their finances efficiently. We will examine the top free budget apps, their functionalities, and what sets them apart from one another.

Overview of Free Budget Apps

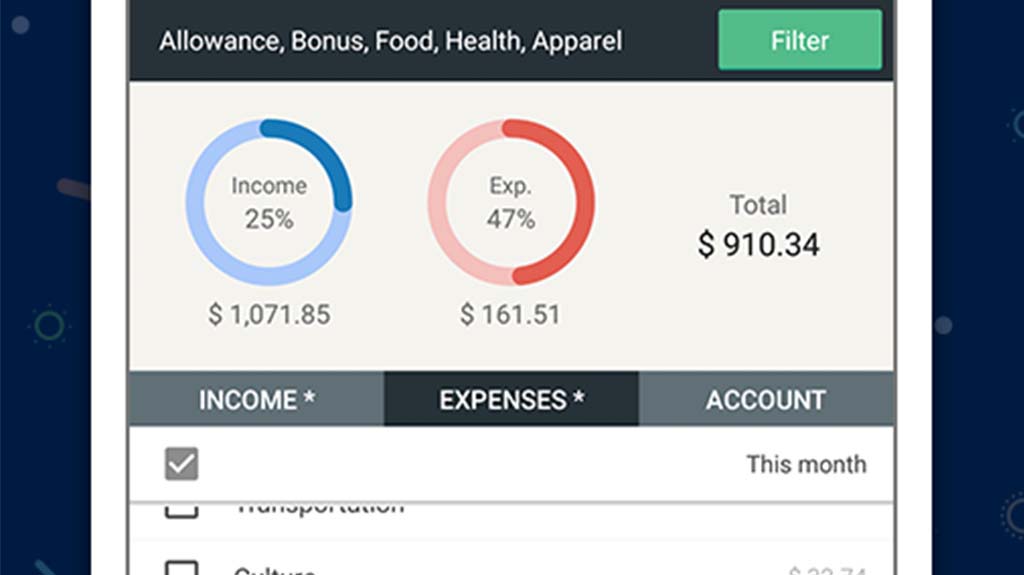

Free budget apps are designed to help users track their income and expenses, create budgets, and set financial goals. These apps often provide features such as budgeting templates, expense tracking, bill reminders, and investment tracking. Some apps also offer additional features like credit score monitoring, financial planning tools, and educational resources. When choosing a free budget app, it’s essential to consider factors such as ease of use, security, and the types of features that align with your financial needs.

Top Free Budget Apps

Several free budget apps stand out for their comprehensive features and user-friendly interfaces. Some of the top free budget apps include:

- Mint: Known for its robust budgeting tools and ability to track bills and credit scores.

- Personal Capital: Offers investment tracking and financial planning tools in addition to budgeting features.

- YNAB (You Need a Budget): Focuses on helping users manage their finances by assigning jobs to every dollar.

- Wally: A simple and intuitive app for tracking expenses and creating budgets.

- Cashbook: Provides a straightforward way to record expenses and income, with features for budgeting and saving.

Each of these apps has its unique strengths and may appeal to different users based on their specific financial needs and preferences. For instance, Mint is highly regarded for its all-inclusive approach to financial management, while YNAB is praised for its methodical approach to budgeting. Personal finance management is a critical aspect of using these apps, as they are designed to streamline financial tasks and provide insights into spending habits.

Features to Consider

When selecting a free budget app, several key features should be considered. These include:

- Security: Look for apps that use encryption and have a strong track record of protecting user data.

- Expense Tracking: The ability to easily log and categorize expenses is fundamental for understanding where your money is going.

- Budgeting Templates: Pre-designed templates can make it easier to create a budget that suits your financial situation.

- Investment Tracking: For those with investments, the ability to monitor performance within the app can be highly beneficial.

- Bill Reminders: Automated reminders can help ensure that bills are paid on time, avoiding late fees and negative impacts on credit scores.

| App Name | Key Features | User Rating |

|---|---|---|

| Mint | Budgeting, Bill Tracking, Credit Score | 4.8/5 |

| Personal Capital | Investment Tracking, Financial Planning | 4.9/5 |

| YNAB | Zero-Based Budgeting, Investment Tracking | 4.8/5 |

Benefits of Using Free Budget Apps

The benefits of utilizing free budget apps are multifaceted. They can help individuals:

- Gain a clearer understanding of their financial situation.

- Set and achieve financial goals, whether it’s saving for a specific purchase or paying off debt.

- Reduce financial stress by staying on top of expenses and ensuring bills are paid on time.

- Make informed financial decisions, such as where to allocate extra funds or how to optimize investments.

By leveraging these apps, users can streamline their financial management, making it easier to adopt healthy financial habits. Moreover, the educational resources provided by some apps can serve as a valuable tool for those looking to improve their financial literacy.

Future of Budgeting Apps

The future of budgeting apps looks promising, with advancements in technology expected to introduce even more sophisticated features. Integration with artificial intelligence (AI) and machine learning (ML) could enable apps to provide more personalized financial advice and automate budgeting tasks further. Additionally, increased focus on security and data privacy will be crucial as more users rely on these apps for sensitive financial information.

What is the best free budget app for beginners?

+Mint is often recommended for beginners due to its user-friendly interface and comprehensive features that cover budgeting, bill tracking, and credit score monitoring.

Can free budget apps help with investment tracking?

+Yes, apps like Personal Capital and YNAB offer investment tracking features, allowing users to monitor their investment portfolios alongside their budgets.

Are free budget apps secure?

+Reputable free budget apps prioritize security, using encryption and other measures to protect user data. However, it’s essential to review an app’s security features and user reviews before signing up.