9 States With No Income Tax To Save Big

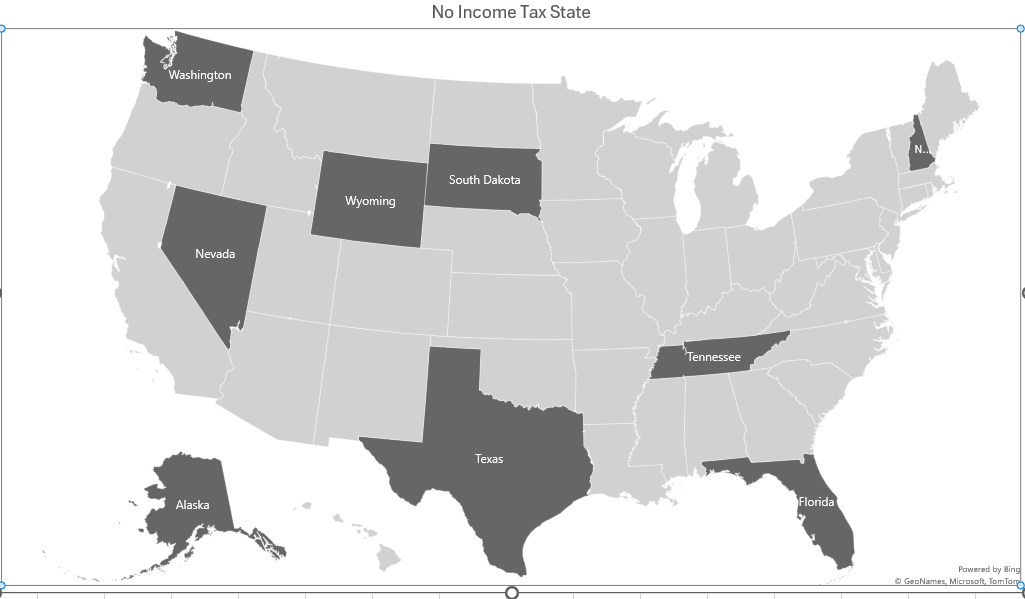

The United States has a complex tax system, with federal, state, and local taxes all playing a role in determining an individual's or business's tax liability. For individuals, one of the most significant tax burdens is the income tax, which is levied by both the federal government and most state governments. However, there are nine states that do not impose a state income tax, providing a potential opportunity for individuals to save big on their tax bills. In this article, we will explore these nine states, their tax environments, and the potential benefits and drawbacks of living in a state with no income tax.

Introduction to States with No Income Tax

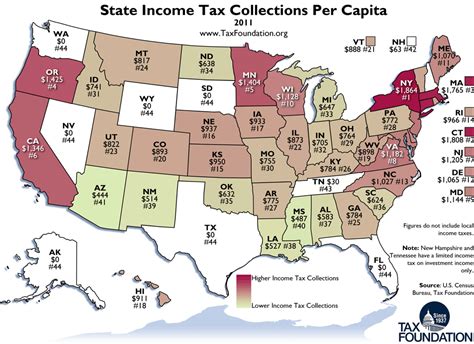

Before diving into the specifics of each state, it is essential to understand the broader context of state income taxes in the United States. State income taxes are a significant source of revenue for most states, with 41 states and the District of Columbia imposing some form of income tax. However, nine states have chosen not to impose a state income tax, relying instead on other sources of revenue such as sales taxes, property taxes, and fees. These states are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Alaska: The Largest State with No Income Tax

Alaska is the largest state in the United States by land area and is one of the most sparsely populated. Despite its size, Alaska has a relatively small economy, with a GDP of around $50 billion. The state has no income tax, and its tax environment is characterized by a low overall tax burden. Alaska’s economy is heavily reliant on the oil and gas industry, which provides a significant source of revenue for the state government. However, the state’s economy has been affected by fluctuations in the global oil market, leading to budget deficits and economic uncertainty.

| State | Income Tax Rate | State Sales Tax Rate |

|---|---|---|

| Alaska | 0% | 0% (but some local jurisdictions impose a sales tax) |

| Florida | 0% | 6% |

| Nevada | 0% | 6.5% |

| New Hampshire | 0% (but taxes certain investment income) | 0% |

| South Dakota | 0% | 4.5% |

| Tennessee | 0% (but taxes certain investment income) | 7% |

| Texas | 0% | 6.25% |

| Washington | 0% | 6.5% |

| Wyoming | 0% | 4% |

Florida: A Popular Destination for Taxpayers

Florida is one of the most populous states in the United States and is known for its warm climate, beautiful beaches, and vibrant cities. The state has no income tax, and its tax environment is characterized by a relatively low overall tax burden. Florida’s economy is driven by a diverse range of industries, including tourism, agriculture, and international trade. The state’s lack of income tax makes it an attractive destination for individuals and businesses looking to reduce their tax liability.

Nevada: A Hub for Business and Entertainment

Nevada is a state located in the western United States and is known for its vibrant cities, including Las Vegas and Reno. The state has no income tax, and its tax environment is characterized by a relatively low overall tax burden. Nevada’s economy is driven by a diverse range of industries, including gaming, tourism, and technology. The state’s lack of income tax makes it an attractive destination for businesses and individuals looking to reduce their tax liability.

New Hampshire: A State with a Unique Tax Environment

New Hampshire is a state located in the northeastern United States and is known for its natural beauty, including the White Mountains and Lake Winnipesaukee. The state has no broad-based income tax, but it does tax certain investment income, such as dividends and interest. New Hampshire’s tax environment is characterized by a relatively low overall tax burden, and the state is often ranked as one of the most tax-friendly states in the country.

South Dakota: A State with a Strong Economy

South Dakota is a state located in the Midwestern United States and is known for its natural beauty, including the Black Hills and Mount Rushmore. The state has no income tax, and its tax environment is characterized by a relatively low overall tax burden. South Dakota’s economy is driven by a diverse range of industries, including agriculture, tourism, and finance. The state’s lack of income tax makes it an attractive destination for businesses and individuals looking to reduce their tax liability.

Tennessee: A State with a Growing Economy

Tennessee is a state located in the southeastern United States and is known for its vibrant cities, including Nashville and Memphis. The state has no broad-based income tax, but it does tax certain investment income, such as dividends and interest. Tennessee’s tax environment is characterized by a relatively low overall tax burden, and the state is often ranked as one of the most tax-friendly states in the country. The state’s economy is driven by a diverse range of industries, including music, healthcare, and manufacturing.

Texas: A State with a Thriving Economy

Texas is a state located in the southern United States and is known for its vibrant cities, including Houston, Dallas, and San Antonio. The state has no income tax, and its tax environment is characterized by a relatively low overall tax burden. Texas’ economy is driven by a diverse range of industries, including energy, technology, and healthcare. The state’s lack of income tax makes it an attractive destination for businesses and individuals looking to reduce their tax liability.

Washington: A State with a Unique Tax Environment

Washington is a state located in the Pacific Northwest and is known for its natural beauty, including the Olympic Mountains and Puget Sound. The state has no income tax, and its tax environment is characterized by a relatively high overall tax burden, due in part to high sales taxes and property taxes. Washington’s economy is driven by a diverse range of industries, including technology, healthcare, and manufacturing. The state’s lack of income tax makes it an attractive destination for businesses and individuals looking to reduce their tax liability.

Wyoming: A State with a Strong Economy

Wyoming is a state located in the western United States and is known for its natural beauty, including Yellowstone National Park and the Grand Teton National Park. The state has no income tax, and its tax environment is characterized by a relatively low overall tax burden. Wyoming’s economy is driven by a diverse range of industries, including energy, tourism, and agriculture. The state’s lack of income tax makes it an attractive destination for businesses and individuals looking to reduce their tax liability.

Which states have no income tax?

+There are nine states with no income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Do states with no income tax have other taxes?

+Yes, states with no income tax often have other taxes, such as sales taxes, property taxes, and fees, to make up for the lack of income tax revenue.

How do states with no income tax benefit taxpayers?

+States with no income tax can benefit taxpayers by reducing their overall tax burden, allowing them to keep more of their hard-earned money. This can be especially beneficial for individuals and businesses with high incomes or those who are looking to reduce their tax liability.