1099: Simplify Tax Filing

The 1099 form is a crucial document for individuals who earn income from sources other than their primary employer. As a self-employed individual or independent contractor, understanding the 1099 form and its implications on tax filing is essential. In this article, we will delve into the world of 1099 forms, exploring their purpose, types, and how to simplify tax filing.

What is a 1099 Form?

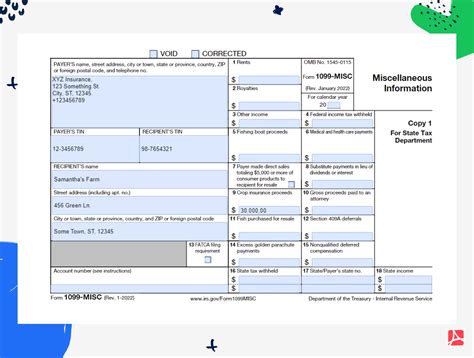

A 1099 form is a series of documents used by the Internal Revenue Service (IRS) to report various types of income that are not subject to withholding. The most common types of 1099 forms include the 1099-MISC, 1099-INT, and 1099-DIV. These forms are used to report income from sources such as freelance work, consulting, interest, dividends, and capital gains.

Types of 1099 Forms

There are several types of 1099 forms, each designed to report specific types of income. Some of the most common types of 1099 forms include:

- 1099-MISC: Reports miscellaneous income, such as freelance work, consulting, and independent contracting.

- 1099-INT: Reports interest income, such as interest earned on savings accounts and investments.

- 1099-DIV: Reports dividend income, such as income earned from stock ownership.

Simplifying Tax Filing with 1099 Forms

Tax filing can be a daunting task, especially for individuals who receive multiple 1099 forms. However, with the right strategies and tools, simplifying tax filing is possible. Here are some tips to help simplify tax filing:

Organize Your 1099 Forms: Keep all your 1099 forms in one place, and make sure to review them carefully for accuracy. This will help you ensure that you report all your income correctly and avoid any errors.

Use Tax Preparation Software: Tax preparation software, such as TurboTax or H&R Block, can help simplify tax filing by guiding you through the process and ensuring that you take advantage of all the deductions and credits you are eligible for.

Consult a Tax Professional: If you are unsure about how to report your 1099 income or need help with tax planning, consider consulting a tax professional. They can provide you with personalized advice and help you navigate the complex tax landscape.

Benefits of Simplifying Tax Filing

Simplifying tax filing can have several benefits, including:

- Reduced Stress: Tax filing can be a stressful and overwhelming experience, but by simplifying the process, you can reduce your stress levels and make the experience more manageable.

- Increased Accuracy: Simplifying tax filing can help you ensure that you report all your income correctly and avoid any errors, which can lead to audits and penalties.

- Maximized Refunds: By taking advantage of all the deductions and credits you are eligible for, you can maximize your refund and keep more of your hard-earned money.

| Type of 1099 Form | Description |

|---|---|

| 1099-MISC | Reports miscellaneous income, such as freelance work and consulting. |

| 1099-INT | Reports interest income, such as interest earned on savings accounts and investments. |

| 1099-DIV | Reports dividend income, such as income earned from stock ownership. |

Common Mistakes to Avoid When Filing 1099 Forms

When filing 1099 forms, there are several common mistakes to avoid, including:

Underreporting Income: Failing to report all your income can lead to audits and penalties, so it is essential to keep accurate records of all your income.

Math Errors: Math errors can lead to delays in processing your tax return, so it is essential to double-check your calculations before submitting your return.

Missing Deductions: Failing to take advantage of all the deductions and credits you are eligible for can result in a lower refund, so it is essential to consult a tax professional or use tax preparation software to ensure that you maximize your refund.

Future Implications of Simplifying Tax Filing

Simplifying tax filing can have several future implications, including:

- Increased Efficiency: By simplifying tax filing, you can reduce the time and effort required to complete your tax return, making the process more efficient and less stressful.

- Improved Accuracy: Simplifying tax filing can help you ensure that you report all your income correctly and avoid any errors, which can lead to audits and penalties.

- Enhanced Financial Planning: By keeping accurate records of your income and expenses, you can make more informed financial decisions and plan for the future with confidence.

What is the deadline for filing 1099 forms?

+

The deadline for filing 1099 forms is January 31st of each year. However, if you are filing electronically, the deadline is March 31st.

How do I report 1099 income on my tax return?

+

You report 1099 income on your tax return by completing Schedule C (Form 1040) and attaching a copy of your 1099 form to your return. You can also use tax preparation software to guide you through the process.

Can I file 1099 forms electronically?

+

Yes, you can file 1099 forms electronically through the IRS’s Filing Information Returns Electronically (FIRE) system. You can also use tax preparation software to file your 1099 forms electronically.