10+ Tax Deadline Secrets For Stressfree Payments

The tax deadline is a critical date that individuals and businesses must adhere to in order to avoid penalties and fines. The Internal Revenue Service (IRS) sets this deadline to ensure that all tax returns are filed and payments are made on time. In this article, we will explore 10+ tax deadline secrets to help individuals and businesses make stress-free payments and avoid any last-minute complications.

Understanding Tax Deadlines

It is essential to understand the tax deadlines and the consequences of missing them. The IRS sets different deadlines for individual and business tax returns. For individual tax returns, the deadline is typically April 15th of each year, while for businesses, the deadline varies depending on the type of business and the tax year. Individuals who fail to file their tax returns on time may face penalties and fines, which can add up quickly. On the other hand, businesses that miss the tax deadline may face more severe penalties, including loss of business licenses and even criminal charges.

Tax Deadline Secrets for Individuals

Individuals can take advantage of several tax deadline secrets to make stress-free payments. One of the most important secrets is to file for an extension if needed. The IRS allows individuals to file for a six-month extension, which gives them more time to gather all the necessary documents and file their tax returns. Another secret is to take advantage of tax deductions and credits, which can help reduce the amount of taxes owed. Individuals can also make estimated tax payments throughout the year to avoid a large tax bill at the end of the year.

| Tax Deadline | Penalty |

|---|---|

| April 15th | 5% of unpaid taxes per month |

| June 15th | Additional 4.5% of unpaid taxes per month |

| October 15th | Maximum penalty of 47.6% of unpaid taxes |

Tax Deadline Secrets for Businesses

Businesses can also take advantage of several tax deadline secrets to make stress-free payments. One of the most important secrets is to keep accurate records of all business income and expenses. This will help businesses ensure that they are taking advantage of all the tax deductions and credits available to them. Businesses can also make quarterly estimated tax payments to avoid a large tax bill at the end of the year. Additionally, businesses can file for an extension if needed, which will give them more time to gather all the necessary documents and file their tax returns.

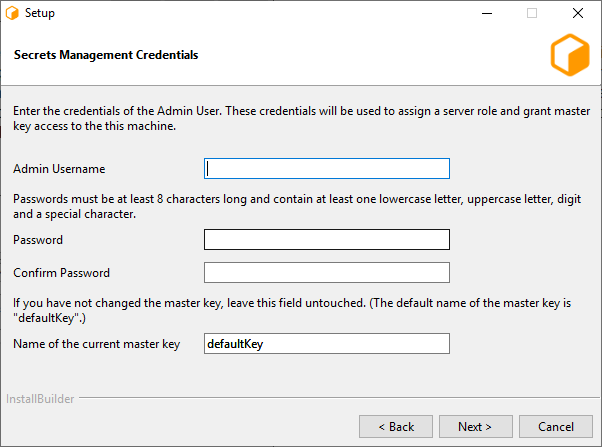

Tax Payment Options

The IRS offers several tax payment options for individuals and businesses. One of the most convenient options is to pay online through the IRS website. Individuals and businesses can also pay by phone or mail a check to the IRS. Additionally, taxpayers can set up a payment plan with the IRS, which will allow them to make monthly payments towards their tax bill.

Tax Deadline Mistakes to Avoid

There are several tax deadline mistakes that individuals and businesses should avoid. One of the most common mistakes is missing the tax deadline, which can result in penalties and fines. Another mistake is not keeping accurate records, which can lead to missed tax deductions and credits. Individuals and businesses should also avoid underestimating their tax liability, which can result in a large tax bill at the end of the year.

- Missing the tax deadline

- Not keeping accurate records

- Underestimating tax liability

- Not taking advantage of tax deductions and credits

- Not making estimated tax payments

Future Implications of Tax Deadlines

The tax deadline has significant implications for individuals and businesses. Missing the tax deadline can result in penalties and fines, which can add up quickly. Additionally, failure to pay taxes can result in tax liens and tax levies, which can have serious consequences for individuals and businesses. On the other hand, meeting the tax deadline can help individuals and businesses avoid these consequences and ensure that they are in compliance with tax laws and regulations.

What is the tax deadline for individual tax returns?

+

The tax deadline for individual tax returns is typically April 15th of each year.

What are the consequences of missing the tax deadline?

+

The consequences of missing the tax deadline include penalties and fines, which can add up quickly. Additionally, failure to pay taxes can result in tax liens and tax levies, which can have serious consequences for individuals and businesses.

How can I make stress-free tax payments?

+

You can make stress-free tax payments by filing for an extension if needed, taking advantage of tax deductions and credits, and making estimated tax payments throughout the year. Additionally, you can set up a payment plan with the IRS, which will allow you to make monthly payments towards your tax bill.